The Bayrou government faces a perfect storm with a confidence vote almost certainly doomed on September 8th and a general strike announced for September 10th, while markets are already punishing a France that now borrows at higher rates than Italy. The 44 billion euros in budget cuts face unanimous opposition that pushes the French signature toward a historic downgrade… TF1 Info

The Facts: What Happened?

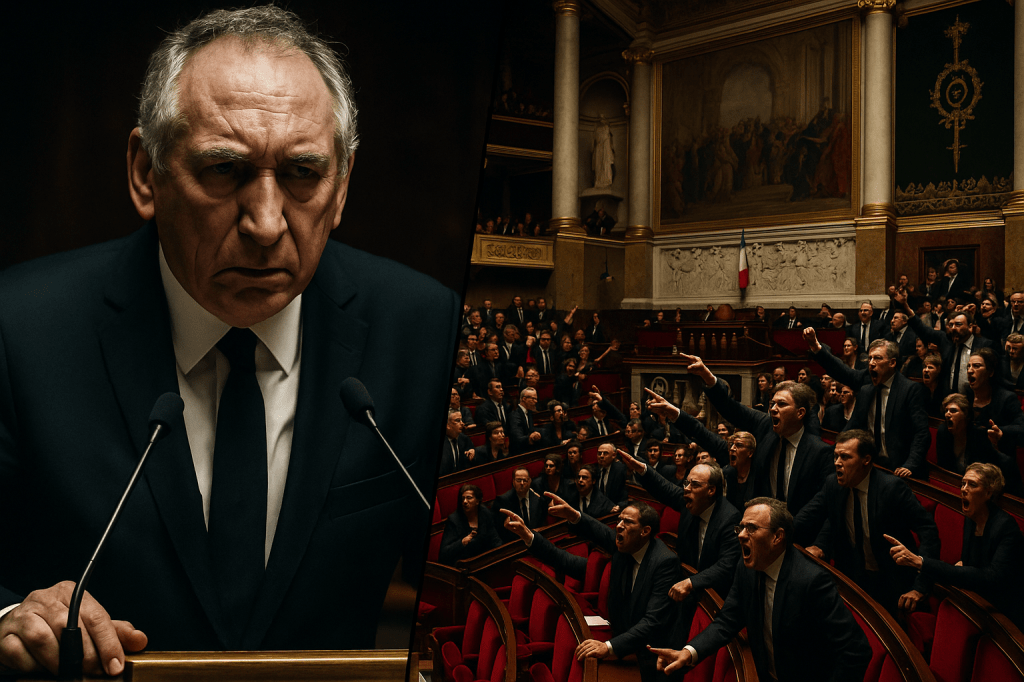

François Bayrou announced on August 25, 2025, that he would engage his government’s responsibility on September 8th before the National Assembly, in accordance with Article 49.1 of the Constitution. This decision comes against a tense budgetary backdrop, with the Prime Minister defending a plan for 44 billion euros in savings to bring the public deficit from 5.8% to 5.4% of GDP in 2025. The plan notably includes the elimination of two public holidays (Easter Monday and May 8th) to save 4.2 billion euros, a measure rejected by 84% of French people according to an Odoxa poll… BFM TV

Meanwhile, the « Block Everything » collective is organizing a general strike on September 10, 2025, supported by major unions (CGT, FO, CFTC, Unsa, FSU, Solidaires). This mobilization aims to contest the austerity plan and provoke a « total shutdown of the country » with blockages of strategic zones, demonstrations in over 150 cities, and massive disruptions in transport, particularly at SNCF where Sud-Rail, CGT-Cheminots, and Unsa call for a massive strike… Mes Infos

Parliamentary arithmetic dooms this confidence vote in advance. All opposition parties have announced they will vote against: the National Rally (123 deputies plus 15 allies), France Insoumise (71 elected), the Greens (38), the Communists (17), and the Socialists (66 deputies). That represents 264 votes against a governmental majority of only 210 seats (Renaissance, LR, MoDem, Horizons). To survive, Bayrou would need almost all 66 Socialist deputies and 23 independents from the Liot group, which Boris Vallaud, president of the PS group, has categorically ruled out… TF1 Info

In-Depth Impact Analysis: Markets and Macroeconomics

The impact on financial markets was immediate and brutal. The CAC 40 lost 3.2% in two sessions (-1.59% Monday, -1.9% Tuesday), with French banks particularly punished: BNP Paribas fell 6.19%, Société Générale 6.31%, and Crédit Agricole 4.51%. This collapse is explained by their massive exposure to French debt, in a context where markets anticipate an imminent downgrade of the sovereign rating by credit agencies… Capital

In the bond market, the situation is even more concerning. The yield on French 10-year government bonds (OAT) surged from 3.39% to 3.53%, returning to its highest levels since March 2025. Even more worrying, the spread with the German Bund has widened to 77-81 basis points, dangerously approaching the critical threshold of 80 points generally considered as a marker of lost confidence. For the first time since 2005, France temporarily borrows at higher rates than Italy, a historic reversal highlighted by Economy Minister Éric Lombard… Trading Economics

The macroeconomic impact could be considerable according to Mathieu Plane, economist at OFCE. Prolonged political paralysis would threaten the deficit reduction trajectory, currently at 5.8% of GDP. The economist estimates that the planned 30 billion euros in structural savings represent a negative impact of 0.6 GDP points on 2025 growth, already fragile at 1.2%. In case of budget plan failure, France would risk a vicious circle where GDP decline would require even greater savings to maintain deficit ratios… The Conversation

Detailed Forecast Scenarios and Strategic Approaches

Synthesizing expert opinions, three main scenarios emerge for the coming weeks and months:

Scenario 1: « Fall and Recomposition » (Probability: 89% according to Polymarket). The catalysts for this scenario are the unanimous opposition of the announced 264 deputies and the mathematical impossibility of obtaining 289 votes. In this case, we would observe Bayrou government resignation as early as September 9th, followed by several weeks of uncertainty while Emmanuel Macron appoints a new Prime Minister. This scenario, favored by Christopher Dembik of Pictet Asset Management, suggests a defensive strategic approach with French asset underweighting and vigilance on crossing the 3.6% threshold for the 10-year OAT, which would constitute a major alarm signal… Le Monde

Scenario 2: « Dissolution and New Crisis » (Probability: 63% of French favor it). This scenario could be triggered by Emmanuel Macron after Bayrou’s fall, although he has expressed opposition to it. Dissolution, possible since July 8th (one year after the previous legislative elections), might seem the only way out of the parliamentary impasse. According to Société Générale Private Banking, this option would represent a major risk with an OAT-Bund spread that could explode beyond 100 basis points, placing France in a situation similar to Italy in the 2010s. Elabe polls give voting intentions similar to 2024 (32.5% RN, 21% united left), suggesting a new ungovernable Assembly… TF1 Info

Scenario 3: « Miraculous Survival » (Probability: 11%). Only a spectacular turnaround by the Socialists would allow government survival. This scenario, deemed unlikely by analysts, would require Bayrou to obtain major concessions on his budget plan. In this improbable hypothesis, Société Générale anticipates a spread tightening to 65-70 basis points and a 10-year OAT decline toward 3.1%. However, even Goldman Sachs, which maintains its BNP Paribas targets at €98.70, acknowledges that this scenario is more about hope than rational analysis… Boursorama

Risk Disclaimer

The information and analysis presented in this article are provided for informational purposes only and do not constitute investment advice, a recommendation to buy or sell, or a solicitation. Past performance is not indicative of future results. Investing involves risks, including the loss of capital. Each investor is solely responsible for their own decisions and risk management.

Conclusion

France is going through a political crisis of unprecedented magnitude under the Fifth Republic, with economic repercussions that far exceed its borders. Unlike Spain and Portugal, which have regained market confidence with respective growth rates of 2.8% and 1.9% and controlled deficits, France is sinking into a spiral of mistrust. The potential IMF intervention mentioned by Éric Lombard, although denied, testifies to the gravity of the situation. With the Fitch agency due to render its decision on September 19th, just after the confidence vote, France is playing its budgetary future and international credibility over the next two weeks. The awakening will be brutal if political actors cannot overcome their partisan calculations to avoid collective shipwreck… Coin Academy

Glossary

- OAT¹ : Obligation Assimilable du Trésor, medium and long-term debt securities issued by the French State.

- Spread² : Yield gap between two bonds, here between France and Germany, indicator of relative risk.

- Basis Point³ : Unit of measurement equivalent to 0.01%, used for interest rate variations.